WHY YOU SHOULDN’T INVEST IN THE MARKET NOW

A risk-based investing strategy suggests that it is better to wait out before investing more into this market for the time being.

V-shape recovery, W-shape recovery, second wave of a global pandemic…you see tons of articles putting out opinions on the possibilities of what is going to happen.

What the market has proven time and time again is that nobody really knows what is going to happen. Some people may have a better understanding of certain data and indicators that may suggest the market is moving in a certain direction (which, don’t get me wrong, can be helpful), but ultimately, there are more than enough case studies showing how investors have been completely wrong in their predictions (my personal favourite – those who thought Bitcoin would reach US$100,000 in 2018)

There is a key guiding principle in deciding what to do now, which has proven true in the last (close to) 15 years of my investing experience. That is:

“Timing the market rarely works, but time in the market almost always works”

The first part of the principle suggests that you should never try to spot the bottom or the top of the market. Investing in the market should also never be led by timing a peak or a trough. Instead, value should drive investing decisions.

A basic application of the second part of the principle is the theory of dollar cost averaging, and that you should generally always “invest” in the market. This continues to remain true, but a more refined version of this is that time will only be on your side if you invest in instruments which are diversified enough such that in the long run, you are more likely to return a positive return.

There’s a graveyard of examples where dollar cost averaging has failed. Another prime example:

Putting it simply, time in the market only works if investments are made on clear risk-based principles.

And based on a risk-based analysis, generally, it makes sense to hold more cash than to be invested now. It’s not clear whether there will be a second crash, a second wave of the global pandemic, honestly no one knows, but in general, the risk factors appear to outweigh the potential returns at this point.

Here are three risk factors which greatly influence this decision:

1. America’s re-election

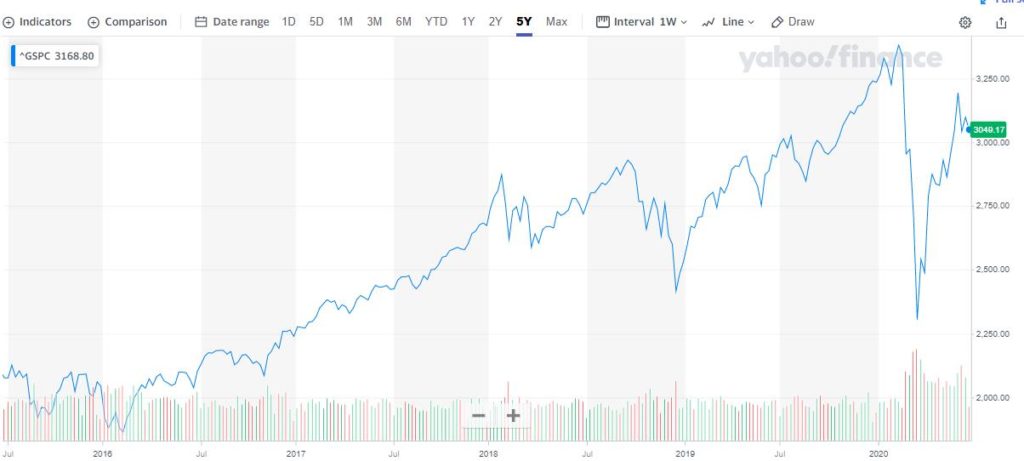

The markets greatly welcomed a president who was pro-markets, growing to great heights to its historical highs in 2019. Although partially muted by the March 2020 crash, the market continues to benefit from the pro-market stance which continues to be glaringly apparent in the current administration (be it in government intervention, policy making etc). What happens if the president is not re-elected for a second term?

2. A potential second wave of Covid-19

The outbreak of Covid-19 global pandemic saw a ~30% drawdown in the markets in March 2020. Countries have closed down their borders, but are slowly starting to open up. The WHO has made it clear that they expect a greater increase in the global pandemic in certain countries where testing has been relatively lax. Countries have seen a need to open up their economies not because it has become safer, but because economies cannot afford to remain closed for any longer. What happens if a second wave of the global pandemic indeed befalls?

3. An irrational market spurred by government intervention

The US recently reported one of the highest unemployment rates (close to 15%) and job losses following the impact of the Covid-19 global pandemic. Notwithstanding, markets continue on a relentless march, almost recovering to pre-Covid-19 prices in their peaks in 2019. There are close to 1.8million confirmed Covid-19 cases. Even as this continues to grow, the market continue to rise as well.

Federal action has helped to spur the economy. Interest rates are close to rock-bottom.

At the same time, in June 2020, investors finally seem to think this bull run may be nearing its end. The market is finally in a generally net-short position, which seems to suggest that people are getting more cautious now. What happens, if they are right?

Taking these three factors into consideration, one thing stands clear to me – the risk of the markets facing a second major correction is extremely high.

This analysis, also bearing in mind the key principle above, suggest that the following action points would make the most sense:

- From a risk-based perspective, it makes sense for the uncertainties to work themselves out before taking a position in the market. From a qualitative point of view, the potential return of the next few months (especially after the massive recover from March 2020) simply doesn’t justify the potential risk you are taking in making an investment now.

- This doesn’t mean you liquidate your long-term positions. Assuming that you had picked up a few value buys (either before or during the March 2020 correction), it makes sense to hold on to these positions in the meantime because there may be no correction at all – timing the market rarely works.

- Accumulate cash, and get ready to invest with a clear plan and strategy if a second correction comes (or not). Regardless of a correction, value buys are always worth buying in the long run. Market correction only brings more value to the table because of corrected prices.

There is another general rule of thumb in investing, which is the 10/20/30 rule. That is, amidst the market generally increasing in the long run, we will see:

- A 10% correction, every 1-2 years

- A 20% correction, every 5-7 years

- A 30% correction, every 10 years

A lot of people refer to the last 30% as a “financial crisis”, which many people also generally think happens once every 10 years.

The general rule of thumb here is to plan allocation on these levels.

We saw a close to 30% correction in the markets on March 2020, which created a lot of value buys at that point in time.

The market has marched back up since then. Who knows, it may continue to increase – but in this case, I’m happy to miss the potential returns for the next few months, in return for greater certainty to where the markets may really be going, in these crazy times we live in.

I’m on a journey to try to make knowledge and education more accessible and affordable, and to sieve out the noise in an age saturated with information. Practicing lawyer by day (I specialize in working with clients in the technology industry), and aspiring technology educator by night, I read widely on four main themes which I believe will change the world we live in: How businesses run and operate, how technology will change the way we do things, how key historical moments changed the way we do things, and how the financial system of the world supports the economy we live in.