Portfolio Insights – FX Fund

This is the first article in a series where I go through components of the model portfolio constructed targeting a 16% annual return. Here, I discuss a FX Fund I recently invested in. Other articles featuring the other components of this model portfolio comprising bond/fixed income, equities, a global macro-quant fund, venture capital and cryptocurrency will be released in time to come.

TL;DR – This FX Fund offers a relatively low risk instrument to gain a steady return of 7-8% yearly (net fees), a target it has consistently achieved (or beaten) for coming to 9 years. Coupled with a steady track record of 100% winning months, as well as sound risk management strategies, this is a great opportunity to consider as part of the lower risk component of an individual’s portfolio, either for the short term while other opportunities are scant, or for the long term, with some attention given as to the sustainability of the current returns. I am personally invested in it.

As some would know, I recently invested into a fund dealing in foreign exchange (“FX”) products. I’ve had a healthy amount of conversation with various people asking for more of my in-depth views on it, so am setting out my assessment on this and how I have viewed this investment in my model portfolio.

On a brief note first, the over-arching context of modern portfolio theory (“MPT”) is critical to evaluating this. The key thing about MPT, or plainly put, portfolio management, is the decision to invest across a stream of financial tools, in order to reduce your risks yet still maintain the ability to achieve the targeted return. The principle can be simplified as this:

It is better to invest in 2 instruments (assuming equally), 1 with a return of 10% and another with a return of 20%, then to invest in a single instrument potentially returning 15%.

Of course, this is a gross simplification and it is a lot more complicated than that, but amateur investors usually make the mistake of always going for the highest possible return. If you read more about MPT, you will start to realize that this is never the best way to invest.

Introduction to the FX Fund and some basic numbers

I won’t be revealing the name of the fund due to regulatory restrictions, so will call this product the “FX Fund”. It runs two separate strategies, and this is a snapshot of the strategy which I’ve invested in:

- Year of inception: 2011

- Operating years (as of 2020): 9 years

- Winning months (months without loss): 100%*

- Maximum live drawdown: -6.38%

- Average monthly return (across 2017-2020): 1.12%

*Yes – it has not had any losing months since inception.

To use the last four years of data, the fund’s average returns are as follows:

- Average yearly return from 2016-2019: 13.25%

- Average monthly return from 2016-2019: 1.106%

The fund charges me a performance fee (no other fees) of 40%, so taking the average monthly return, my average net returns for each year would be 7.96% (so not accounting for any compounded returns).

The strategy

Now that we have a brief understanding of the numbers, let’s go into the strategy of this fund. This is the culmination of quite a bit of discussion with the fund’s management, leaning on some reliable expert advice from friends and discussion with other learned individuals. Ultimately though, since I don’t operate or run the fund (nor am I a professional trader), these views are largely based on my own understanding.

The FX Fund runs a strategy most commonly known as Arbitrage Trading. Arbitrage trading is simply taking advantage of market inefficiencies where there is a price differential between the same product in different markets, and buying/selling them to take advantage of the price differential. Once again, at the risk of gross simplification, to give a crude example, if a mango is sold at Market A for $1, but sold at Market B for $1.01 at the same time, you would buy a mango at Market A for $1 and sell it at Market B, to immediately earn the $0.01 return.

As investopedia puts it: Arbitrage funds work by exploiting the price differential between assets that should theoretically have the same price.

Obviously this is a gross simplification because financial markets are a bit more complicated than that. I won’t go into too much detail, but the point to note is that arbitrage investing here is different from “investing” as conventionally referred to. Arbitrage trading is in finding price inefficiencies, as opposed to “value” buys.

You can read more about the basics of arbitrage trading here and here.

Specific to this fund, since this is an FX product, mispricing opportunities are basically found in the FX market. The fund trades in the G10 Currencies. and specifically, across 3 currency pairs to find mispricing opportunities. Investopedia has a good example here as following:

The current exchange rates of the EUR/USD, EUR/GBP, GBP/USD pairs are 1.1837, 0.7231, and 1.6388, respectively. In this case, a forex trader could buy one mini-lot of EUR for USD 11,837. The trader could then sell the 10,000 Euros for 7,231 British pounds. The 7,231 GBP could then be sold for USD 11,850 for a profit of $13 per trade, with no open exposure as long positions cancel short positions in each currency. The same trade using normal lots (rather than mini-lots) of 100,000 would yield a profit of $130.

If you think about, arbitrage trading, in theory, should be a risk-less trade, since trades are executed simultaneously. However, I’m pretty sure that some degree of risk is involved, since (1) executing an order in the financial market is a lot more complicated than buying a mango; and (2) there are execution/transaction costs that are involved. I discuss the risks of arbitrage trading a bit more below.

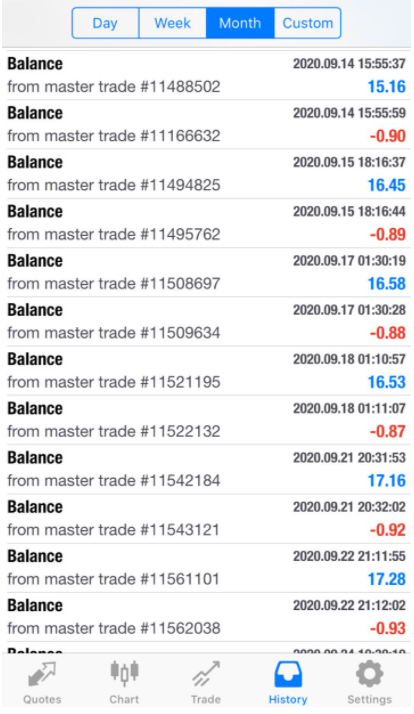

Nonetheless, as far as I am aware, the above principles of arbitrage trading roughly capture the strategy in the fund’s trading actions. This also aligns with the trading records which are made available to you, where the timing, sizing and win/loss patterns of the trades are generally what one would expect with arbitrage trading.

The three factors you should be taking note of are (1) timing of the trades; (2) sizing of the wins and losses; and (3) overall frequency of the trades. You realise that the trades are really done in pairs, with a pair of win/loss trades being near simultaneous trades. Generally, these accord with an arbitrage trading strategy.

I’ve drilled down a bit more with the management in terms of the ability to capture these opportunities, and why they can find inefficiencies in a relatively efficient market (G10 currencies are heavily traded so market correction occurs pretty frequently). What I understand is that so far, they have been able to do this because of a preferential liquidity partner which they are partnering with. Once again, I won’t go into detail about the roles of a liquidity partner vis-à-vis trading funds, but suffice to know for this, this strategy remains sustainable for as long as the fund is able to partner with reliable liquidity partners, which earns its commission on the spread it receives. In some way, you can think of it as a “key supplier” in a traditional business.

Evaluation

Is this an investment opportunity worth considering? In summary, my answer is yes, which is why I’m personally invested into this. I set out below what I think are the pros and cons of this investment, in bite size snippets for ease of digestion:

Pros

- Fantastic track record – past performance is no guarantee of future performance, but a 100% winning months track record is a pretty solid track record. What this simply tells me is that the team has gotten the arbitrage trading strategy right

- Relatively low risk strategy – if you haven’t realized by now, the key advantage of an arbitrage strategy is that it is relatively low risk. It is not no risk (which I alluded to), but in short, coupled with the track record above, I’m relatively comfortable that this investment is a low risk investment in terms of how it’s being executed and the potential loss one would face

- Risk/reward ratio – more importantly flowing from point 2, an average return of 7-8% of the risk you are bearing is a relatively respectable return. Similar instruments which have given that return include investing in certain ETFs (with dividends reinvested), or at best BBB bonds. Both require a bit more managing, and expose you to what I deem as higher risks. Yes, there are also a variety of robo-advisors which seem to beat/match rates, but (1) are you bearing the same risks; and (2) do they really have a track record of performance?

- Low correlation to market – one of the key critical factors here is that the performance of the fund (which is a result of the strategy employed) is that it is largely uncorrelated with the market. Basically, from the track record and history, this is a relatively stable instrument that gives you a consistent return, largely independent of whether the markets crash or rise.

- No lock-in – there is no lock-in period, so you can withdraw your money anytime. That said, withdrawals can take up to 30 days (in order for trades to clear), and there is a relatively hefty withdrawal fee (con) for each withdrawal.

- Risk control – the fund doesn’t expose more than 20% of capital, so there is an immediate closure of trading once a 20% loss is sustained.

- Managed accounts – unlike other traditional funds, funds remain in your name “legally”, held in a custodian account. How the fund manages your money is that it enters into a “power of attorney” contract whereby you cede control of the specific trading account, which is in your name, to the fund. The key implication here is that in the event of insolvency, your money is still legally yours.

Cons

- Arbitrage risk – I won’t go into the technical details, but, unexpected occurrences can definitely happen whereby price inefficiencies reverse the other way, causing arbitrage trades to make a loss. This likely explains the maximum live drawdown that occurred. That said, in the event this occurs, this is probably symptomatic of a larger problem (for example, you can read about inverse yield curves in the fixed income market), which is likely to affect the market throughout in any case

- Withdrawal fees – the fund charges a US$100 withdrawal fee for any withdrawal of any amount at any point in time

- Relatively high performance fees – the fund charges a 40% performance fee, which is relatively high. That said, you can simply evaluate on this a total returns basis

- Reliability on liquidity partner – as mentioned above, the ability to do (so) well on this strategy has thus far relied on its liquidity partner. This is a key risk because in the event the liquidity partner starts to change its fee structure, then there will be less opportunities.

- Currency risk – the fund trades in USD, so if your base currency is not in USD, you will need to account for any risk in currency movements with your base currency

- Sustainability – I’ve kept this for the last because this needs a bit more explanation. Because this is an arbitrage strategy, bear in mind, arbitrage only exists in inefficient markets. Since the market naturally corrects itself, these opportunities will get lesser and lesser as markets become more and more efficient. What this means is that in some way, there will be an “upper limit” to how much this fund can trade before these opportunities start to become unavailable, since the quantum traded will affect. Without going into specific numbers, I’m aware that as of 2020, the fund has estimated that it is at about (just shy of) 70% of total capacity, meaning that it will stop any allocating further funds to this strategy once it reaches 100% in order to ensure that returns continue to be sustainable.

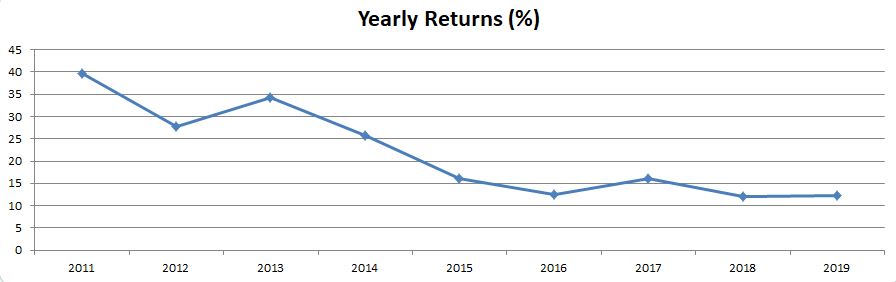

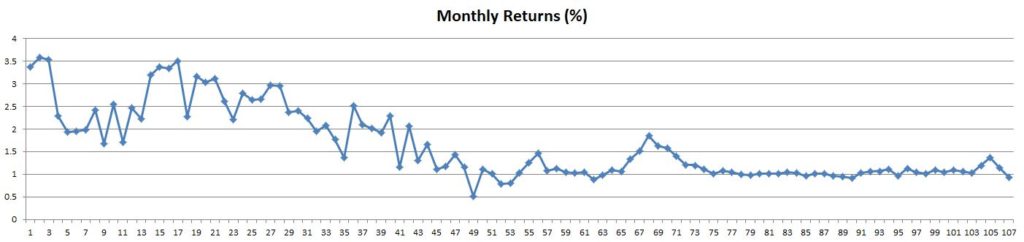

This is also relatively apparent from the track record of returns, which I’ve set out across the life of the fund from a yearly and monthly perspective:

The trend here is clear – at least till 2015/2016, the fund managed to exploit price inefficiency at a greater scale. However, as assets under management increased, this has started to reduce as each trade “corrects” the market to a greater degree, and therefore, causes the opportunities to be less. The good thing though, is that since 2015/2016, the fund has largely managed to deliver a very consistent return of about 1% a month.

Taking into consideration both the pros and cons, this is a very viable opportunity for investors looking to allocate into a lower risk product which is largely uncorrelated to the market. The key risk here we are really looking at are (1) unexpected occurrences; and (2) sustainability of the strategy. For the first risk, as mentioned above, this is likely to affect the market at large, so this is not particularly unique to this strategy. In any case, suitable maximum-loss strategies will help to limit the risk altogether. In relation to the second risk, this simply calls for a re-evaluation of your investment occasionally, in the event returns are showing to fall. This would have been done for any other investment as well, so likewise, is not particularly unique to this strategy.

Let me know if you would like to speak more about this, and I’ll more than happy to share further thoughts and details on this instrument.

Disclaimer: In some instances, we get a referral fee for investments if certain conditions are met and you’ve been introduced based on our referral. It’s a small way to be compensated for the time, effort and research put in. Nonetheless, we would only recommend any instrument we would (and have) personally put our money in, and the objective remains the same – to ensure that good quality knowledge is as accessible as possible.